Insurance companies do cover metal roofs as they are durable, though cost more upfront than alternatives like asphalt shingles; check with your provider on specifics as metal roof eligibility and premiums vary.

Metal roofs last decades, but cost more upfront. Do insurance companies cover them? Some do, but metal roof eligibility and premiums vary widely by provider. Check with yours to see if they cover this increasingly popular durable option. Key factor: metal resists storms well.

Metal roofs are durable and withstand harsh weather well. Some insurers offer coverage, but policies vary. Compare options based on storm resistance, lifespan, and upfront cost. Regular maintenance, including fix a gutter that is falling off, ensures longevity.

Key Takeaways

- Metal roofs are usually covered by insurance due to their durability.

- Check your policy and ensure compliance with local building codes.

- Maintain documentation for smoother insurance claims.

- Some insurers offer discounts for impact-resistant metal roofs.

- Regular maintenance preserves coverage and prevents claim denials.

- Discuss your metal roof with your agent for optimized coverage.

- In Florida, metal roofs may lower insurance costs.

- Enjoy energy savings and reduced premiums with a resilient metal roof.

Does A Metal Roof Always Lower Your Insurance?

Metal roofs can often snag you a discount on home insurance. Insurers like their durability against things like hail and fire. Just check your policy some companies are more metal-friendly than others.

But, there’s no one-size-fits-all rule. Ensure your metal roof meets local codes and keeps good records. Regular maintenance helps too. Bottom line, talk to your insurance people and they’ll break it down for you.

Homeowners Insurance And Metal Roofs

Good news: most home insurance covers it. Metal roofs are tough, resisting fire and hail damage. Check your policy details, meet codes, and keep records for smooth coverage. Regular upkeep helps too. Talk to your insurer, stay covered!

Longevity

Metal roofs mean longevity. They last, standing strong against time. Insurance likes that, so you’re in good hands for the long run.

Durability

Metal roofs are champs in durability. They stand strong against fire and harsh weather. Tough roofs mean insurance likes you, and you’ll likely be covered.

Fire Resistance

Metal roofs rock for fire resistance. Insurance digs that. Tough roofs mean peace of mind for you. Secure your home metal style!

Does Home Insurance Cover Metal Roof Issues?

Most home insurance covers metal roofs. Check your policy for specifics. Metal roofs can be durable, often getting coverage for fire and hail damage. If you have one, make sure it meets local codes, and keep installation records.

Some insurers give discounts for impact-resistant roofs, like metal. Regular maintenance can help too. Talk to your insurance agent for the right coverage.

A Metal Roof May Reduce Your Insurance Costs

| Key Point | Metal roofs can reduce insurance costs due to their durability against hail and fire. |

| Policy Check | Verify your insurance policy for potential discounts related to metal roofing. Policies vary among insurers. |

| Documentation | Maintain records of metal roof installation, adhere to local codes, and perform regular maintenance for prolonged coverage. |

| Insurer Discussion | Engage with your insurance agent to understand specific coverage details and explore potential cost reductions with a metal roof. |

Switching to a metal roof can cut insurance costs. It’s strong against hail and fire, making insurers happy. Check your policy and discuss potential discounts; savings might be just above your head!

Metal roofs meet codes; keep records for claims. Regular maintenance ensures good coverage. Talk to your agent, secure the right protection. Your wallet might thank your new durable roof.

Metal Roof Lower Your Insurance In Florida

In Florida, choosing a metal roof can lead to lower insurance premiums. The durability of metal makes it resilient against hurricanes, reducing the risk of damage and earning you potential savings.

Its fire-resistant properties contribute to a safer home, garnering extra discounts from insurers and providing long-term financial benefits.

Get Insurance To Pay For Roof Replacement

When your roof suffers damage, insurance can be your financial safety net. Don’t overlook the importance of having insurance to cover the costs of a roof replacement. It safeguards your home and wallet from unexpected expenses.

Investing in insurance ensures that you won’t bear the burden alone when facing the need for a roof replacement. A well-protected roof means peace of mind and a shield against the unpredictable elements.

How To Get Insurance To Pay For Roof Replacement?

To get insurance to pay for roof replacement, start by reviewing your policy to understand what’s covered. Contact your insurance company promptly after discovering roof damage. Provide clear documentation of the damage, including photos and estimates from reputable contractors.

Be prepared to answer questions about the cause of the damage and any maintenance history for your roof. Follow up with your insurance adjuster to ensure they have all the information they need to process your claim efficiently. If your claim is approved, work with your insurance company to choose a contractor and schedule the replacement.

Need A New Roof Will Insurance Pay

If you need a new roof, will insurance pay for it? The answer depends on various factors. Firstly, check your policy coverage. Some insurance plans cover roof replacement due to specific reasons like storm damage or wear and tear.

Next, consider your roof’s condition. Insurance may cover replacement if it’s damaged by a covered peril. If the damage is due to lack of maintenance, you might not be covered. Always consult your insurance provider for clarity on what your policy includes and excludes regarding roof replacement.

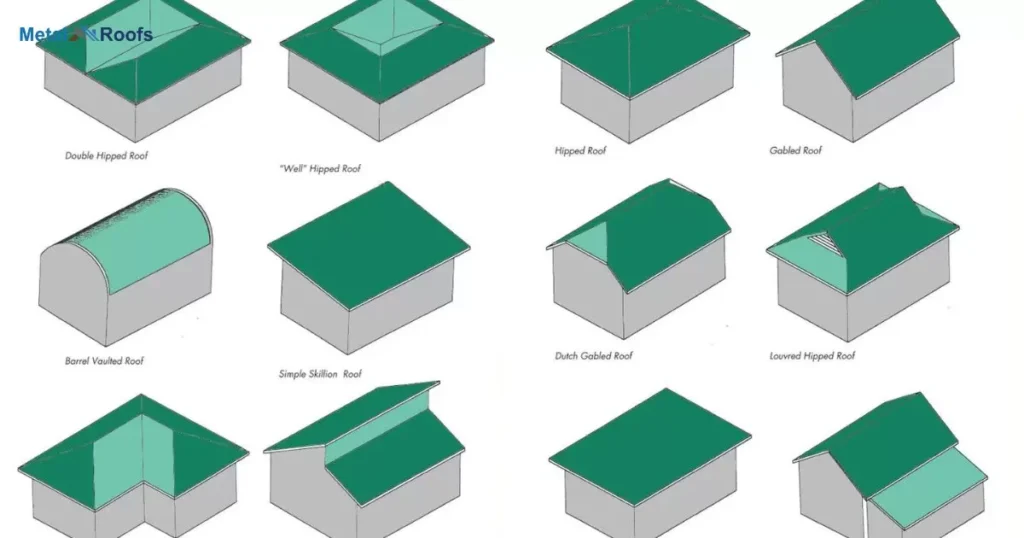

Roof types for insurance purposes

When it comes to insurance, the type of roof on your home can impact your coverage and premiums. Here are some common roof types and how they may affect your insurance:

Asphalt Shingles: These are the most common type of roofing material in North America. They are generally affordable and offer decent durability. Insurance companies typically view asphalt shingle roofs favorably.

Metal Roofs: Metal roofs are known for their longevity and durability. They can withstand harsh weather conditions better than many other types of roofs, which can lead to lower insurance premiums.

Tile Roofs: Tile roofs are durable and can last a long time, but they can be expensive to repair or replace. Some insurance companies may charge higher premiums for homes with tile roofs due to the higher replacement costs.

Wood Shake/Shingle Roofs: While aesthetically pleasing, wood shake or shingle roofs can be more susceptible to fire damage, mold, and rot. Insurance companies may charge higher premiums for homes with this type of roof.

Slate Roofs: Slate roofs are extremely durable and can last for decades. However, they are also expensive to install and repair. Insurance companies may consider homes with slate roofs to be lower risk and offer lower premiums.

Flat Roofs: Flat roofs require special maintenance and are more prone to leaks than sloped roofs. Insurance companies may have specific requirements for flat roofs, such as regular inspections and maintenance, to maintain coverage.

Green Roofs: Green roofs, which are covered with vegetation, can offer environmental benefits such as improved insulation and stormwater management.

When shopping for homeowners insurance, it’s important to discuss the type of roof on your home with insurance providers to understand how it may affect your coverage and premiums.

Frequently Asked Questions

How long should a metal roof last?

A well-maintained metal roof can last 40 to 70 years, providing long-lasting durability and weather resistance.

What is functional damage to a metal roof?

Functional damage to a metal roof disrupts its ability to provide effective weather protection and compromises its structural integrity, often involving issues like leaks or corrosion.

Does a metal roof lower your insurance in Florida?

Yes, a metal roof in Florida can lower insurance premiums as it’s more durable and resistant to severe weather, making homes less susceptible to damage. Insurance companies often offer discounts for these risk-mitigating features.

Conclusion

Metal roofs have pros and cons. They resist weather and last for decades. But they come with higher initial costs. Some insurance companies will cover metal roofs due to durability, though provider policies differ greatly. Consider storm protection, lifespan and expense.

If you install a metal roof, research insurance options carefully before deciding. Providers vary widely on metal roof coverage and premium costs. Compare plans based on weather resistance, longevity and your budget. An insured metal roof means long-term financial protection.